Kevin's Weekly Health Tech Reads 3/7

Lots of public markets activity between Alignment's S-1, Anthem's investor day, Clover earnings, and Oscar and InnovAge's IPOs; Rock Health's digital health adoption report; & more!

Reads for the week of 2/28 - 3/6

Alignment S-1:

Alignment Healthcare’s S-1 is out and I gotta say it was quite a refreshing read with a lot of depth and detail on the business performance. Alignment has been a relatively un-hyped startup compared to some of its peers, but it appears to be quite competent at operating a Medicare Advantage plan without sustaining massive losses. Link (S-1).

A quick overview: Alignment offers Medicare Advantage plans in 22 counties in California, North Carolina, and Nevada with 81,500 members across those markets. They’re currently at only 3% share across those counties, with the highest penetration approaching 10% - 20%. So you can see why their top growth strategy is penetration in existing markets, followed by expanding into new markets. Alignment did $960 million of revenue in 2020, up 27% over 2019. Adjusted EBITDA was essentially breakeven in 2020 at $12 million, after losing $12 million in 2019. Its Medical Benefit Ratio was 82.6% in 2020, down from 87.2% in 2019. Pg 12, 77, 88.

Of 2020 revenue, $873 million was premium dollars and $82 million was in capitated payments from other payors. Capitation payments are down from $124.6 million in 2019, which it seems is a deliberate move away from that for Alignment as two payor contracts that drive the majority of that capitated revenue have been terminated over the last two years. Pg. F-7, F-13.

A handful of data points highlighting Alignment’s competence operating an MA plan: Alignment boasts an NPS of 66, which is really solid - i.e. compare that to Oscar’s NPS of 44 in the 65+ population. Additionally, over 99% of their California members have been in 4 Star or higher plans between 2018 - 2021. MBRs go down for Alignment from 90% - 95% for new members to 70% - 75% over time with members who have been in the plan for 5+ years. Pg. 2, 84, 86.

This is an interesting albeit a bit blurry chart describing how Alignment categorizes different market types - urban, rural, ethnically diverse, and socioeconomically diverse - and its performance in each. Interesting to see Los Angeles boasts the best MBR, as well as 48% of members being dually eligible. Pg. 84.

Alignment appears to do a lot in terms of offering new plan designs based on the market types they’re entering and consumer they’re targeting. In 2019 Alignment launched a ‘Black Card’ for their HMO and special needs plans, which appears to be a pre-paid debit card with a fancy name. They’re launching a virtual MA plan in 2021. They’ve also built a plan design called Harmony centered around eastern medicine. The table on page 113 highlights their different plan designs well, super cool to see and appreciate how much they share.

Alignment shared some interesting details on its clinical model as well - check out the chart below. They bucket members into one of four categories: Healthy, Healthy Utilizer, Pre-Chronic, and Chronic. In 2019, Chronic were only 9% of members but they accounted for 65% of claims. It’s interesting to note that the Pre-Chronic category is their “high-risk” flag - members who don’t have claims yet but they expect will rise into the chronic category. This seems to be why it accounts for 9% of the population but only 2% of spend. The breakdown provides another helpful reminder of how concentrated medical costs are in the high cost population - the 74% of members in the Healthy category only drive 5% of costs. Pg. 117.

As mentioned in the chart above, Alignment has a “Care Anywhere” program that now serves over 4,000 high-risk members. The average Care Anywhere member is 77 yrs old, has 36 visits per year, 5-6 chronic conditions, and average monthly spending over $2,500. The program has an NPS of 76. While it was home-care it now sounds like its primarily virtual. With COVID-19 this program went from 97% in home visits to 83% phone / virtual since April 2020. They provide some real world case studies of the impact of Care Anywhere on patients as well which are helpful to read through and make the interventions a bit more tangible. Pg. 105, 118.

Direct Contracting only gets a very brief mention in the S-1, with Alignment noting that they expect to be assigned ~1,500 to 2,000 members via Direct Contracting in 2021. For comparison: this is 100x less than Clover is telling analysts it will hit in 2021. Pg. 49.

Alignment is relatively coy in the S-1 about its relationship with providers, although apparently it sees an opportunity to partner with other provider groups as a means to accelerate growth and improve performance. They also say they have a track record of enabling other practices to succeed in managing MA patients, albeit without much data in the S-1 supporting that. Will be curious to watch if they become a player in the race to gobble up physician practices. Pg. 12, 123.

It’ll be interesting to see how this one is received by the markets given the recent stumbles of Clover and Oscar; however, it seems that Alignment provides a relatively safer option for folks who have been scared off by Oscar’s financial losses and Clover’s, well, basically everything.

Other News:

Anthem hosted its annual investor presentation this week, and if you want to watch the two and a half hour video it’s linked below. One of the most notable items in the call was to hear Anthem’s CEO Gail Boudreaux kick it off by saying “the traditional insurance company that we were has given way to the digitally enabled platform for health we are becoming”. It’s fascinating to me that even the one of the largest insurers in the country doesn’t want to be thought of as just an insurer anymore, opting instead to become a “digitally enabled platform for health” whose business just happens to be insurance. A few notes below. Link (video). Link (presentation).

The digital platform was a key topic of the presentation, but the analysts seemed a bit confused by the tangible impact of the digital platform on the overall business, which was largely missing from the presentation. I counted three separate questions from analysts trying to understand how the digital transformation was going to either impact top line growth or cost structure for the business. While you’d hope to see more specific data on the impacts of digital, it was interesting to see Boudreaux’s articulation of the digital strategy as “using digital as a platform to get a bigger part of the health care total dollar.” (She said this in analyst Q&A).

The Diversified Business Group segment discussion toward the end of the presentation was interesting. DBG is the group that includes assets such as CareMore and Aspire, as well as behavioral (Beacon) and analytics. This group currently manages 7% of Anthem’s medical spend, and expects to be managing 25% of Anthem’s medical spend by 2025. It’s selling solutions to other Blues plans - 29 of the 35 non-Anthem Blue’s plans use at least one of their products. CareMore and Aspire currently serve over 100,000 Anthem members.

It was curious to see which startups Anthem chose to mention and not mention. It featured ongoing work with TytoCare and Aunt Bertha during the presentation. But Sharecare, which now has a significant relationship with Anthem, was not mentioned once in the investor presentation. Presumably it is behind a number of the AI initiatives Anthem discussed. Odd.

This is an excellent tweet storm by Dan O’Neill highlighting the recent InnovAge IPO, a PACE provider. Worth reading through to see how much money can be made in the PACE program (if that’s not already evident from the tweet - a company with 6k patients is worth $3.2 billion).

CMS pressed pause on the Geographic Direct Contracting model this week. Seemed like the writing was on the wall for this to happen when the National Association of ACOs asked for a halt of the program back in December. Their concerns were centered around the administrative complexity and confusion for patients, which I’d imagine played a major role in this decision. Link.

Oscar priced its IPO this week at $39.00 per share, valuing it at $9.5 billion. Of course, the post-IPO pop that some of us were perhaps expecting did not materialize, as Oscar shares fell throughout the week, closing the week at $31.00 per share. Link.

Clover Health reported earnings for the first time as a public company and it went about as poorly as it could have, both in terms of poor Q4 2020 performance as well as a worse outlook for 2021 already adjusting projections downward. The analyst Q&A session was rough - lots of questions about management guidance relating to Direct Contracting, 2021 enrollment, and medical cost trend. Not great. Link.

Amazon Care has filed paperwork to expand to 17 states beyond Washington, where it is currently providing virtual primary care services in the Seattle area. Link.

Interestingly, Amazon Care also was part of an announcement that it is joining a coalition of home health providers aimed at ensuring site of service flexibility for care delivery for in-home care after the pandemic. The other members of the coalition include home health providers such as Landmark and Dispatch Health. A virtual-only provider seems like an odd duck as part of that group… something to keep an eye on. Link.

Optum and Atrius Health, the largest independent provider org in Massachusetts, formally signed their merger agreement. Link.

In-home visit startup Heal announced a partnership with Medly for Heal patients to get prescriptions delivered in-home same-day by Medly. These sort of partnerships make a ton of sense - I’d imagine a few years down the road we’ll be seeing some partnerships like these turning into acquisitions. Link.

In-home medical care provider DispatchHealth raised $200 million at a $1.7 billion valuation. You gotta imagine they have an eye on an IPO coming up next right? Link.

TytoCare, the in-home medical kit maker, raised $50 million. It doubled revenue last year and performed more than 600,000 exams consults globally. Link.

Redox, a startup building an API layer to integrate patient data into the EHR, raised $45 million. Link.

Health Gorilla, another startup working on an API layer for clinical data, raised $15 million. Link.

SpineZone raised $12 million for a combo in-person / virtual care model for musculoskeletal issues. Link.

Sharecare, fresh off it’s recent SPAC announcement, landed Wellstar as both a client and new investor as Wellstar put $10 million into Sharecare. Wellstar will become the first “Sharecare-enabled health system”. Link.

Reperio Health raised $6 million to build a remote monitoring kit for employers. Link.

Spark Advisors launched a tech-enabled Medicare brokerage and raised a $3.6 million seed round. Link.

Opinions:

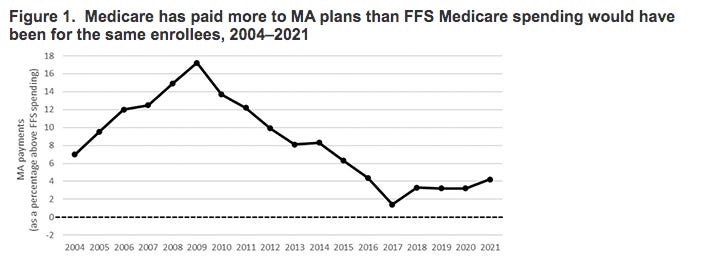

MedPAC and AHIP appear to be in a bit of a online shouting match over the costs of Medicare Advantage compared to Medicare FFS. AHIP argued last week that a MedPAC analysis (see chart below) showing that Medicare Advantage costs more per patient than Medicare FFS was wrong because it wasn’t comparing patients properly. AHIP, not surprisingly, instead thinks that MA is significantly cheaper per patient than Medicare FFS. It’s a bit comical to me to watch two organizations like this arguing over what the proper ‘apples-to-apples’ comparison is to know which population is cheaper. I have no idea how to know who is right in this argument, but given how many investors are drooling over the MA market at the moment I’m inclined to think MedPAC might be on to something here. Link.

This is a good read from Olivia Webb’s Substack on what happens next with telehealth, arguing that telehealth is becoming a commodity and that we’re going to see a wave of M&A in the space this year following Cigna’s recent deal with MDLive. Link.

This is an interesting interview with Brightline’s CEO Naomi Allen by Vivien Ho and the Wharton Pulse crew. Brightline, a startup building a virtual platform addressing mental health for kids, was originally going to be a combo virtual and in-person model before COVID-19 hit. Interesting to see a bit on their offerings and go-to-market strategy. Link.

The Healthbox crew penned an interesting piece on virtual specialty care models, looking specifically at how cardiology is primed to go virtual. Link.

Data:

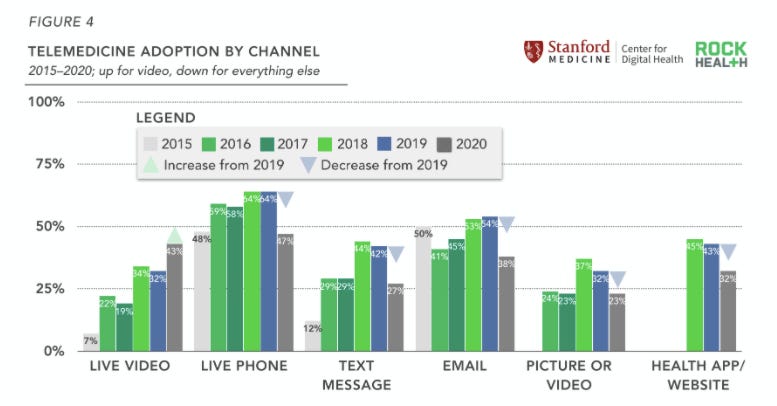

Rock Health released its annual consumer adoption report, and as usual it is full of really interesting findings about digital health usage in 2020. I for one am shocked that the only form of telehealth that saw an increase in 2020 was video visits - phone, text, email, and picture were all down significantly over the last few years. Worth checking out for anyone in the space. Link.

This KFF report found that if commercial and individual insurance paid providers at Medicare rates, it would reduce healthcare spending by $350 billion in 2021. Only challenge is that suggestion also creates 350 billion reasons why health systems will never let that change actually happen (see: Colorado, North Carolina). Link.

Here’s an interesting study suggesting rural residents are twice as likely as urban residents to leave their Medicare Advantage plans and switch to Medicare FFS. Link.

Jobs:

Aetna is hiring a Director of Enterprise Strategy. Link.

Brightline, a virtual mental health platform for kids, is hiring a bunch of different roles across clinical, marketing, product, tech, and more. Link.

CoachMe, a non-profit startup building a chronic disease platform addressing gaps in health equity, is hiring an engineer. Link.

Cohort Health, a care management platform using AI to close gaps in care, is hiring a sales exec. Link.

Cricket Health, a startup building a new care model for kidney disease, is hiring three full stack engineers. Link.

Devoted Health, a Medicare Advantage insurance startup, is hiring a Head of Security. Link.

Dreambound, a company helping job seekers become Certified Nursing Assistants, is hiring a growth marketing lead. Link.

Included Health, an org working to create a better healthcare experience for the LGBTQ+ community, is hiring for a bunch of roles. Link.

Manatee, a digital mental health platform for kids, is hiring a clinical content strategist. Link.

Millie, a new maternity care startup, is hiring a VP of product and VP of engineering. Link.

PathAI, an AI platform for pathology, is hiring a couple different roles across partnerships, machine learning, and product. Link.

Pestle Health, a startup building D2C sexual health solutions starting with PrEP, is hiring a VP of operations. Link.

Samaritan, a startup helping individuals find stable housing, is hiring a senior director of growth. Link.

Spark, a startup building a Medicare brokerage, is hiring for operations and engineering roles. Link.

Well, a startup helping employees navigate healthcare needs, is hiring a senior director of design. Link.

Workit Health, a digital platform for substance abuse disorders, is hiring a financially oriented COO. Link.

Vim, a company building digital infrastructure for payer-provider partnerships, is hiring a Manager for their Provider Success team. Link.