Kevin's Weekly Health Tech Reads 3/21

agilon health's S-1; a lot of employer innovation news (Grand Rounds / Doctor on Demand, Transcarent, and Amazon); and other stuff

Reads for the week of 3/14 - 3/20

The agilon health S-1:

Another Medicare Advantage startup going public as agilon health filed its S-1 this week. Link.

agilon helps independent physician groups take global risk on Medicare Advantage populations. They enter a market with a long term, 20-year partnership with a local practice. agilon has grown quickly, starting in 2017 and hitting 131,000 Medicare Advantage members at the end of 2020, up from 90,200 at the end of 2019. It’s geographic footprint is still relatively small, operating in 11 markets today with 6 more going live next year - almost 40% of its membership is in five markets in Ohio. agilon’s medical service revenue was $1.2 billion in 2020, up from $789 million in 2019 (and $196.5 million in 2017). The breakdown of medical spend in their P&L is a little confusing, so I made this chart below to make sense of it for myself. Essentially, it looks like they paid out $1.1 billion in medical costs in 2020, up from $767 million in 2019 (via FFS claims, shared savings with their anchor partner, and new market entry costs). agilon’s costs of operating the platform in existing markets were $100 million in 2020 and $89 million in 2019, meaning its costs to operate in existing markets were essentially breakeven in 2020 and -8% in 2019. Pg. 21, 80, 82, 84.

While the existing MA markets are getting close to profitability, agilon’s entire book of continuing operations lost $107 million in 2019 and another $57 million in 2020. The organization has accumulated losses of $551 million since it was started in 2017. agilon cites an Adjusted EBITDA metric that makes the losses look less significant - it went from a $57 million loss in 2019 to $6 million profit in 2020. The Adjusted EBITDA number gets to profitability by excluding cost to enter new markets, among other things. It would appear they’re trying to demonstrate that agilon will flip to profitability as soon as it stops investing in growth. Pg. 23.

The S-1 glosses over a seemingly complicated and confusing backstory. It was born in 2016 at the hands of PE firm Clayton Dubilier & Rice, which appears to have acquired provider groups in California and in Hawaii. Interestingly, the California business seems to have been an unmitigated disaster that was jettisoned in 2020 due to poor financials. It appears that agilon still bears some liability on that business and that the DMHC in California is still sending agilon “investigative interrogatories” as recently as March 9th this year. The Hawaii business is still around, but treated as a confusing footnote throughout the S-1 that clearly doesn’t fit in the growth story. The California business lost agilon nearly $170 million in 2019 alone, before it sold off the assets in 2020. Note that agilon sold its Fresno clinic for $19.2 million to Babylon Health. Pg. 43, 85, 91, 92.

The agilon growth story that appears in the S-1 started in 2017 via a partnership with COPC, a independent provider group in Columbus, Ohio. Given the nature of these relationships, it’s not surprising to see the CEO of COPC joined agilon’s Board in 2017 and remains on it today. COPC features prominently throughout the S-1, for instance in this case study that demonstrates nicely agilon’s growth strategy of landing and expanding in a region. Pg. 31, 123, 126, 145.

The emphasis on the anchor physician groups, both COPC and others, is evident throughout the S-1. Check out the chart below - in each of their markets they list out the anchor physician group and some of the characteristics. They place a heavy emphasis throughout the S-1 on working with providers with long tenures in local markets, versus a number of the other MA clinic models that are hiring new docs to operate in their clinics. Not too many S-1s where you’ll see physician partners called out like this, highlighting the close relationship between agilon and them. Pg 116.

With each anchor physician group, agilon attempts to help them get better at managing medical spend over time. agilon demonstrates that in existing markets this has proven true, and that we should expect to see continued improvement in their Medical Margin number over time. This will be a key number to watch to see how consistently they can continue improving it over time. Note the differences in Medical Margin PMPM in each geography, highlighting how variable some of this work is market to market (Geography 1 appears to be Columbus and the COPC relationship). Pg. 81.

agilon has contracts with 15 payors across its 17 geographies, and that revenue is heavily concentrated within the usual suspects - Humana makes up 38% of revenue, while Humana, Aetna, and UHC make up 69% of revenue. Pg 129.

agilon’s strategy should allow it to grow over time in a lower cost manner than the MA players building clinic from the ground up. They highlight two ways they will grow over time: 1. expanding within its existing geographies, and 2. entering new geographies. Entering new geographies appears to offer more growth potential for them, but is harder to execute on given the nature of convincing a provider group to sign a 20 year agreement. Launching a new geography costs them $4.2 million on average. Once they’re in a market, it becomes relatively straightforward and inexpensive for agilon to grow members, working in partnership with the provider group to flip more members to MA. agilon sees a growth opportunity of 375,000 patients over the next five years in existing markets, with 220,000 patients that are currently Medicare-eligible but not in MA, and another 156,000 who are within 5 years of aging into Medicare. They mention Direct Contracting as an opportunity here as well, expecting to hit 50,000 members this year in their DCEs. Pg. 82, 104, 105.

The S-1 provides a very helpful description of how agilon pays providers under its ‘Total Care Model’ if you are interested in the mechanics of how these models work for providers. Essentially it appears that they pay out fee-for-service claims to all providers, including the anchor physician group, and then share in savings with the anchor provider group that they’ve formed the risk-bearing entity with. Pg. 127.

In summary, lets take a look at what a bull and bear case might look like for agilon:

Bull case: agilon has demonstrated it can effectively partner with local provider organizations and help them take on a meaningful book of MA global cap payments and generate meaningful shared savings payments for providers. Growing to 127k MA members and $1.2 billion of revenue in eleven geographies in four years is incredibly impressive when you look at how hard it has been for other MA new entrants to scale. It’ll be able to use these results to enter new partnerships with provider orgs in new markets efficiently, and once it gets into a market the world is agilon’s oyster. There is huge upside over time within each anchor practice partner - converting more patients to MA, expanding the model to FFS Medicare (i.e. Direct Contracting), etc. These anchor relationships are gold mines of recurring revenue that agilon is just starting to tap into and will generate significant cash flow for them.

Bear case: agilon only has 16 practice partnerships and hasn’t actually demonstrated it can get any of them to profitability in a sustainable manner. While the revenue and membership growth is impressive, it shows how quickly these models can grow when attributing existing patient populations to them rather than building de novo patient panels. They haven’t managed FFS spending like other MA models and are barely breaking even in existing geographies. Look no further than the California experience to see how badly this can go. Growth is going to be slow as other provider groups are going to wonder why they need to pay agilon a portion of their shared savings, over twenty years. Once providers realize they can operate these models themselves they’re going to balk at agilon’s model. It’s destined to remain a niche player in a few geographies that’ll struggle to scale enough to support the platform / growth costs it’s incurring today. At some point the Federal government will look harder at all the money being made in Medicare Advantage and squeeze the profits from a model like this.

Other News:

Lots of big moves in the employer innovation market this week as everyone races to become the trusted partner to employers in managing their healthcare spend:

Second opinions platform Grand Rounds and telehealth platform Doctor on Demand have announced that they’re merging. According to this article, Grand Rounds most recent valuation was $1.3 billion while Doctor on Demand was $820 million. The combination of capabilities appears to make a lot of sense for both parties as they seek to expand their offering to employers and become the all-encompassing partner. Feels like we’re in a total arms race at the moment to win these relationships, and I am guessing that the opportunity to cross-sell products to each other’s employer customer base provides near term financial synergies as well. Link.

Transcarent officially launched this week and announced Glen Tullman will be the CEO in his encore gig post-Livongo. Transcarent is going after the employee navigation space that Accolade and others have found success in, with an interesting twist on pricing model where Transcarent takes $0 up-front from employers and shares in savings generated. Transcarent’s solution appears quite wide-ranging with a virtual primary care / navigation solution that connects into Centers of Excellence. Given Tullman’s success with Livongo, it’s not hard to imagine Transcarent doing really well selling into the employer market with this value prop. Link.

Amazon Care is expanding its virtual care delivery solution nationally this year and will begin selling to employers. Obviously, this will be a curious one to watch given Amazon’s heft. Link.

The American Hospital Association is asking the DOJ to review Optum’s recent acquisition of Change Healthcare over antitrust concerns. The AHA argues that there are two primary concerns: 1. there’s less competition in the claims clearinghouse space as Optum and Change would become one entity; and 2. that the combination of each entity’s dataset creates competitive concerns. Not surprisingly, the recent UHG comments about intended growth in the provider space and subsequent moves in acquiring providers have caught the attention of the AHA as well and are featured prominently in the document. Will be interesting to watch what comes of this, as well as future UHG moves. Link.

Social determinants of health network Unite Us raised $150 million at a $1.6 billion valuation. It appears that they have separated themselves from the pack of SDoH startups at this point. Makes sense to raise a big round now and do a land grab to become the defacto SDoH network in as many markets as you can. It seems like once Unite Us entrenches itself in a market it’ll be hard for others to displace it. Link.

Kidney care startup Strive Health raised $140 million. Link.

Data analytics startup Clarify Health raised $115 million. Link.

Happify Health, a digital therapeutic company focused on mental health, raised $73 million. Link.

Viz.ai, an AI startup, raised $71 million beyond the initial use case of stroke care to other spaces including cardiology, pulmonolgy and trauma. Link.

Glooko, a diabetes disease management startup, raised $30 million. Link.

NephroSant, a startup building a diagnostic test to determine whether a kidney transplant is being rejected, raised $16 million. Link.

Heard, a platform for independent mental health practices, raised $1.3 million. Link.

Humana is rebranding its various services businesses, including Parnters in Primary Care, under a new brand called CenterWell. Link.

Opinions:

Per usual, the Substack Healthcare Writer’s Guild came through this week with some interesting content to peruse:

Nikhil Krishnan shared some interesting thoughts on what clinics might look like in the future - pop-ups, mobile clinics, co-working spaces, microclinics, and more. Link.

Brendan Keeler wrote about the personal health record. He presents some good thoughts on why PHRs have struggled historically, suggesting they haven’t been solving problems for the majority of the population. Link.

Sachin Jain wrote about the challenges large companies have innovating in healthcare. I think that most folks who have worked at big companies in healthcare will be nodding their heads at everything written in here about the challenges large organizations face when attempting to innovate. I’d also expand the argument more generally than the piece does. Many of these challenges described I think would be true of any organization (big or small) trying to change things that they are not financially incentivized to change. And that is the underlying problem here - organizations have no incentive to make the changes described. Change the financial incentives and watch how fast big healthcare organizations change in response (look no further than the adoption of video visits in COVID last year for example 1A of this). Link.

Data:

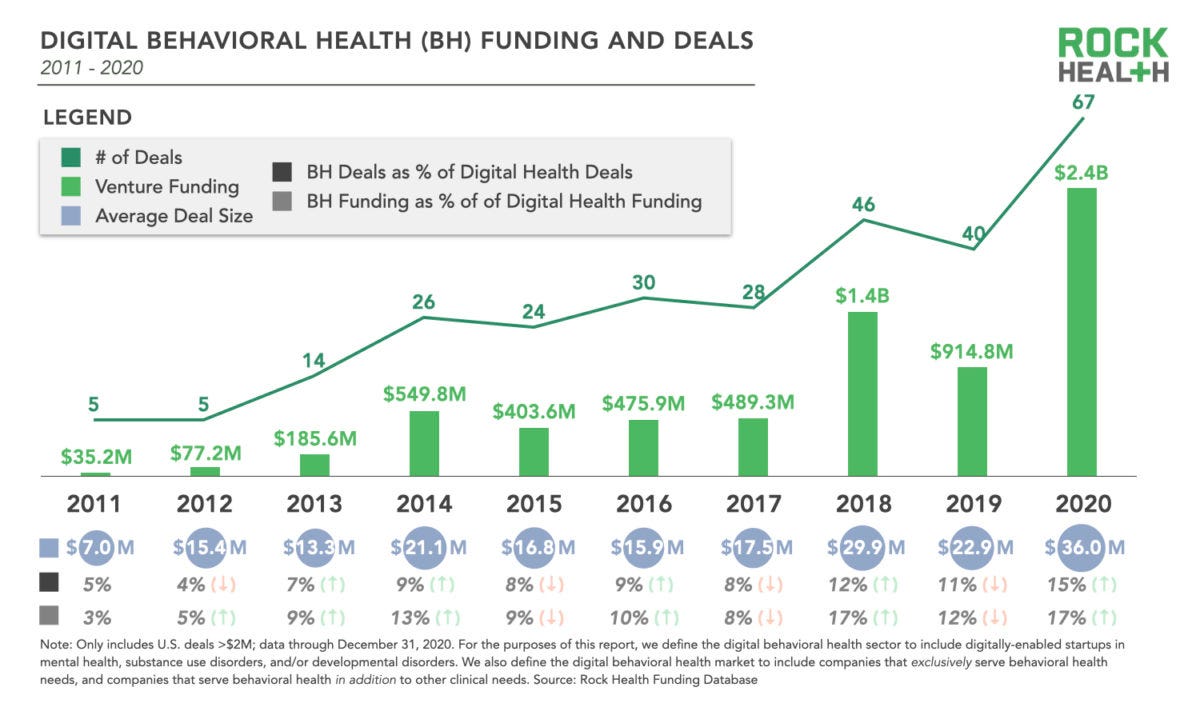

Here’s a good look at investment activity in the behavioral space by Rock Health, hitting 67 VC deals and $2.4 billion invested in 2020. Link.

Jobs:

Algorex, a data analytics startup, is hiring a number of roles across customer success, data science, engineering, and sales. Link.

BioBridge, a cardiology remote patient monitoring platform, is hiring a sales leader. Link.

Bright.MD, a virtual care platform for providers, is hiring a product marketing lead. Link.

Devoted Health, a Medicare Advantage insurance startup, is hiring a strategy / ops role and a marketing manager among other roles. Link.

EQUIP, a startup building a new care model for eating disorders, is hiring a VP of Engineering. Link.

Included Health, a platform for the LGBTQ+ community, is hiring a bunch of different roles. Link.

Lively, a startup making hearing aids, is hiring a director of finance among other roles. Link.

Myia Health, a remote monitoring platform, is hiring a lead mobile engineer. Link.

Ophelia, a telehealth platform for substance abuse treatment, is hiring a number of different roles. Link.

Portfolia, a fund focused on investing in women- and minority-led startups, is hiring a sales leader. Link.

Propeller Health, a digital therapeutic for asthma, is hiring a user growth associate. Link.

Surescripts, a data platform for e-prescribing, is hiring a senior business advisor. Link.