Kevin's Weekly Health Tech Reads 10/11

Clover goes public via SPAC, Walmart entering brokerage business in a big way, Humana's state of value based care initiatives, lots of funding rounds & more!

Reads for the week of 10/4 - 10/10

News:

Clover, the Medicare Advantage insurance startup with ~57,000 members, announced it is going public via a SPAC at a $3.7 billion valuation (a valuation of roughly $65k per life covered). I’ve written a very long post over on Medium digging into various aspects of the Investor Presentation and transaction which you can check out so I won’t go too far into it here, beyond offering a couple thoughts below. Link (Investor Presentation & Conf Call).

Here’s my TL;DR on my Medium deep dive: Clover sounds an awful lot like a regional provider-sponsored Medicare Advantage plan that raised a bunch of VC money to build a cool tech platform to support the providers and scale the approach nationally. Unfortunately while Clover was building out the tech it has screwed up on the MA plan and tanked its quality ratings. The MA plan hasn’t demonstrated it can scale anywhere beyond New Jersey - where its friendly providers are - and Clover appears to be shifting its focus to drive future growth by becoming a tech platform / MSO for primary care docs in the nascent Medicare Direct Contracting space. That move certainly may work out well and Clover could take off in that space, but the concept seems more belief-driven than fact-driven at this point based on whats shared in the investor deck. The investor deck as a whole seems at best misleading as to current state of the business. Link (my Medium article).

Dan O’Neill had a really good take over on Twitter this week as well that is worth checking out:

I've been mulling @Clover_Health's (superficial) investor deck. While I see huge potential in MA & other value-oriented models, my TL;DR take is: 1- Nothing here clearly establishes Clover as a differentiated MA plan 2- The Direct Contracting pivot is *very* interesting 1/n$IPOC is merging with @Clover_Health to help bring better healthcare across America. Our one pager is attached. You can register to hear about the transaction from myself, Clover CEO Vivek Garipalli and President Andrew Toy at 4pm ET here: https://t.co/X7LOQCPEsz https://t.co/zXQNhc7dF7

I've been mulling @Clover_Health's (superficial) investor deck. While I see huge potential in MA & other value-oriented models, my TL;DR take is: 1- Nothing here clearly establishes Clover as a differentiated MA plan 2- The Direct Contracting pivot is *very* interesting 1/n$IPOC is merging with @Clover_Health to help bring better healthcare across America. Our one pager is attached. You can register to hear about the transaction from myself, Clover CEO Vivek Garipalli and President Andrew Toy at 4pm ET here: https://t.co/X7LOQCPEsz https://t.co/zXQNhc7dF7 Chamath Palihapitiya @chamath

Chamath Palihapitiya @chamathWalmart announced that it is getting into the Medicare brokerage space in all 50 states in time for open enrollment this year. It’s yet another move for Walmart demonstrating its interest in the healthcare space. As this article notes, it seems like a loss for the brokerage companies who now have a huge new competitor, but a win for the insurance companies as Walmart can help drive more demand. It is interesting to note the list of insurers whose product Walmart will sell - Humana, UHC, Wellcare, Anthem BCBS, Amerigroup, Simply Health, BCBS Arkansas, and Clover Health. Clover has quite the advantage with Walmart versus the other MA startups. Link.

HCA decided to return all of its $6 billion of COVID-19 aid it received from the government this year. Good for them for making the decision to do this. Link.

AmWell’s stock jumped this week on speculation that UHG might be making a bid to acquire it. It would make sense that UHG would be considering a move in this space given the limited number of scaled players and the Livongo + Teladoc merger. Link.

Avail Medsystems raised $100 million for its telemedicine technology for the operating room. It looks a lot like its building one of those cart + screen with a doc things that a bunch of hospitals have, so I’m assuming that the tech is better here? Link.

Lark Health, a digital therapeutics startup, raised $70 million, $55 of that equity, and expanded its partnership with Anthem. Lark is now powering digital coaching through Anthem’s member facing app, as well as being the preferred Diabetes Prevention Program provider. Link.

TigerConnect raised $45 million for its care coordination platform. Link.

Datavant, a data integration platform for providers, raised $40 million. Link.

Cerebral raised $35 million for its digital mental health platform focusing on medication management and therapy for anxiety and depression. Link.

Abridge, software for helping patients record and understand their visits with providers, raised $15 million. It currently has 50k users on the platform. Super cool concept that I hope takes off. Perhaps it’s not surprising to see this mostly funded by tech VCs given the nature of it (i.e. the business model is gonna be a challenge). Although it is quite interesting to see UPMC as an investor here. Link.

nOCD, a virtual platform for treating OCD, raised $12 million. Link.

Curation Health raised an undisclosed Series A for its value based care workflow platform for providers. Link.

Opinions:

Here’s an interesting piece from Lily Bernicker at the Collaborative Fund on the virtual care tech stack. She outlines three areas where companies are lowering the barriers to starting virtual care companies by building infrastructure - shared services, automation, and interoperability. Makes total sense. Although, I gotta stay I disagree with the underlying thesis in the article:

Now that patients are comfortable and providers can get paid for telehealth, the biggest barriers to more creative virtual care platforms are technical.

If anything, the rapid adoption and subsequent decline of telehealth earlier this year would point to exactly the opposite - provider practices demonstrated that they are able to convert almost their entire practice to virtual visits, essentially overnight. That leads me to believe tech is not the barrier to adoption. Rather, the barrier lies primarily in financial and regulatory incentives. Link.

On the subject of barriers to virtual care adoption, Chrissy Farr wrote a really good article on the regulatory challenges virtual care platforms face regarding whether the COVID-19 emergency changes could be walked back at some point. In particular, the change around allowing providers to work across state lines where they’re not licensed. She references Talkspace, a mental health startup, that has sent a memo to providers offering to indemnify providers of any legal issues they might run into if they continue to practice across state lines. It seems like a major hurdle facing virtual care platforms as they attempt to scale services and meet patient demand with limited numbers of providers on the platform. If those providers can only practice in certain states, the virtual care platforms can meet less demand needs. Again, this doesn’t seem like a tech problem that’s the barrier to the adoption of virtual care. Link.

This is a good perspective from Kim Bellard on Walmart’s moves in healthcare, specifically with a focus on the Medicare Advantage space and Clover insurance deal, which seem to be accelerating at a very rapid pace recently. It is quite interesting that in the insurance plan Clover + Walmart members will receive a $100 credit for OTC products at Walmart every quarter. I can imagine the Walmart insurance agents selling that benefit like crazy - you’re already a Walmart shopper and get a free $400 per year? Sign me up! Link.

Walmart isn’t the only new entrant going after insurance, and this piece explores what Apple, Amazon, Facebook and Google are doing in the space. It provides a good quick summary of recent activities by each of the three tech companies without going too in depth on any. Link.

This is a interesting read from John Norman on the Apple watch’s new pulse oximeter feature and the impact it can have on tracking your health. Link.

Data:

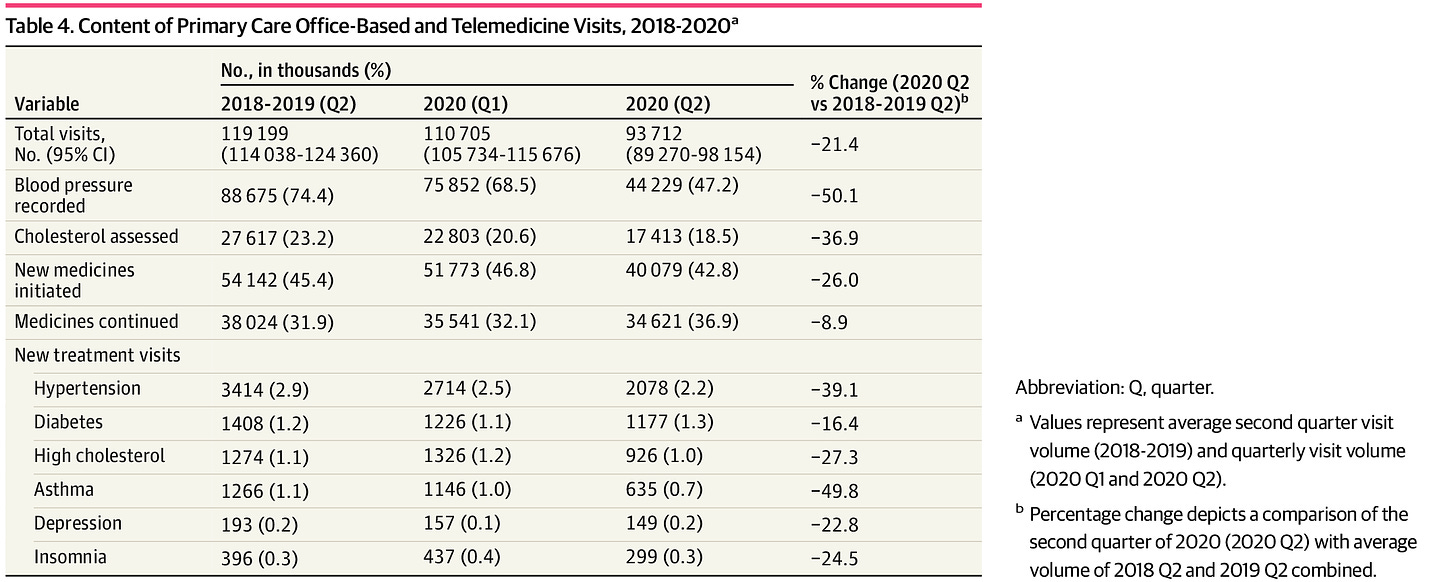

This article in JAMA looks at how the content of primary care visits and visit types changed during the initial COVID-19 surge versus historical patterns. The data show in person visits declining and telehealth visits rising as many others have shown as well at this point, but whats more interesting is the examination of how the content of the visit changed - while total visits dropped 21%, blood pressure recordings dropped 50% (which makes sense as its a bit harder to do that via telehealth). Link.

Here’s another really good read from Howard Miller at CHQPR on how the new CMS model for rural care may drive increased financial issues at rural hospitals. It does a nice job going into the details of the capitated payments that CMS is suggesting rural hospitals will receive as part of this model, arguing that it will cause overall payments to go down and increase financial losses for rural hospitals, particularly small ones. Link.

Humana released a report on the status of its value based care initiatives. 19% of Humana’s MA population is in global risk agreements, while 67% are in some sort of risk arrangement. Telehealth claims went from under 10,000 in February to 1.125 million in April, back to 394,500 in July. Lots of good stuff in this. Matthew Holt posted a good series of tweets on the report over on Twitter as well. Link.

Clover's latest Medium article is funny too: "One of us — Vivek — is the son of two doctors".... one of whom is a convicted felon for healthcare fraud: https://www.justice.gov/sites/default/files/usao-nj/legacy/2013/11/29/GaripalliInformation.pdf

https://medium.com/clover-off-the-charts/founders-letter-who-we-are-and-why-we-exist-6d732266113e

This is a great collation, Kevin...@Opinions- telehealth- maybe there is also some more work to be done to improve patient experience and overall care coordination, apart from the reg/fin incentives?